Disclaimer: This post contains affiliate links, where we may be compensated for any purchases you make. This does not affect the price you pay. Thanks for supporting our site! 🙂

Two of the leading international money transfer services — TransferWise and WorldRemit — offer some great deals for customers needing to send money abroad, but which service is best?

Here’s our indepth analysis of what both services offer, and which one wins in the battle of TransferWise vs WorldRemit…

Contents

TransferWise Review

About

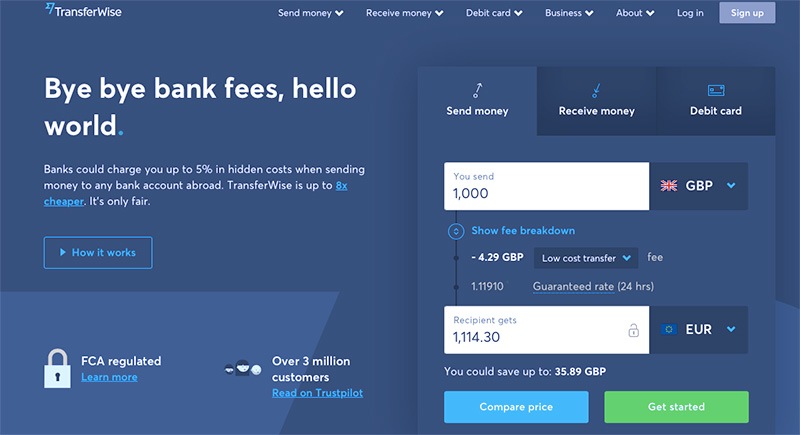

Launched in 2011, TransferWise uses local peer to peer transfers instead of international transfers to make sending money abroad up to 8 times cheaper than with foreign bank transfers.

For example, if someone wanted to convert their pounds to euros, TransferWise looks for other TransferWise users who want to transfer euros into pounds, and then pays out money from their account into the other destination account, thereby making the transaction between two accounts using euros and eliminating the need to transfer money internationally.

At the UK end, TransferWise searchers for other accounts wanting to transfer in the opposite sense, moving money between accounts to complete the transaction.

TransferWise pricing is transparent, the exchange rate is the genuine one matches the currency flows at the real mid-market exchange rate , and fees are clearly displayed when making any transaction.

Doing things this way means customers can avoid traditional banking fees altogether and money isn’t lost by transferring at an unfair exchange rate.

To make a transfer, simply go to the TransferWise website and set up an account.

You’ll need to verify your identity by uploading proof of ID and proof of address.

Once your account is set up, just type in your and the recipient’s details and the amount you want to transfer. You can then either fill in your debit card details or send the money to TransferWise from your online bank account.

The sender is notified by a confirmation email when the money has been received by TransferWise and another when it’s been successfully paid to the recipient.

The majority of transfers take only 24 hours to complete, with many being completed within minutes.

Transfers can be tracked via the award winning mobile apps and the TransferWise website from any location.

TransferWise currently operates in more than 40 countries around the world, being able to send and receive money in 22 currencies and being able to send out but not receive money in 27 others, however they are continually expanding their currency network.

TransferWise Fees

All TransferWise fees are disclosed upfront before any transactions are finalised.

A small flat fee is charged for each transaction, plus a percentage of the amount converted.

Fees and percentages change depending on your destination country, and can be worked out using the online fee calculator on the TransferWise website.

For example, if you want to transfer £1000 to a Euro account, you will be charged a percentage of 0.035% as well as a flat rate of £0.80 (so minus £4.29 in total).

However the same transaction to Australian Dollars is charged at 0.045% and a flat fee of £1.00, meaning your total fees come to £5.48. The fees will be taken out of the amount total before the amount is converted into another currency.

TransferWise Pros

- Very safe and secure

- Uses a real, up to date exchange rate

- Very cost effective

- Works for large or small transfers

- User friendly and easy to use

- Accurate and timely

- High daily transfer limits

TransferWise Cons

- Not all currencies are available

- Transfers are made to other bank accounts only, not as cash pickups or mobile money

- Some documentation required to sign up to the service

- Transfers can sometimes be delayed

WorldRemit Review

About

This online only platform has a strong focus on remittances, where the idea is to cut prices as much as possible, and allow people around the world to send money to their friends and family abroad.

WorldRemit’s service is currently available to senders in 50 countries, with money being delivered to bank accounts, as cash, to mobile wallets, as bank deposits, or as airtime in over 140 countries around the world.

By staying mobile, WorldRemit removes costs that would otherwise be transferred to its customers, and WorldRemit already holds funds in all the countries we send to, so transfers are almost instant.

Customers can transfer money anywhere and at any time using the WorldRemit website or mobile Android and iOS apps.

The process is quick and simple.

The first step is to choose the country where you would like to send money, followed by how you want that money to be sent (as cash or mobile money, for example).

Once you enter the amount you wish to send and in what format, the fees and exchange rates — as well as an estimated delivery time — are clearly shown.

The next step is to enter the recipient’s details, and then choose to pay either by bank account or debit/credit card.

Once you have checked all your details and clicked send, your money will be instantly on its way to the destination account.

As soon as the transaction is complete, both the sender and the recipient will be alerted with an SMS and email.

WorldRemit Fees

When using the WorldRemit service, fees are dependent on the pay out method you choose and the destination country.

For example, when sending money to Spain from the UK as a bank deposit, a flat fee of £2.99 is charged for any given amount.

However sending amounts over £20 to Thailand as a bank deposit incurs a flat fee of £3.99, and the fee remains the same should you wish to send money as a cash pick up.

All fees and exchange rates are transparent and visible before committing to send money.

WorldRemit Pros

- Convenient, easy to use service

- Low fees

- Good rates of currency exchange

- Secure and safe

- Money is delivered quickly

- Service is available across a wide range of countries

- Fees and exchange rates are shown upfront

- Money can be sent in a variety of different forms

WorldRemit Cons

- Less cost effective when transferring larger amounts of money

- Maximum amount you can send from the UK is limited to £8,000 per transaction

- Certain transfers such as bank transfers are not instant

- Not all types of sending service are available in all countries

TransferWise vs WorldRemit: Overall Verdict

There are benefits and drawbacks to using both TransferWise and WorldRemit.

WorldRemit has better global coverage, particularly for more developing countries, yet TransferWise imposes less limits on the daily amounts you can transfer.

Also, while WorldRemit charges lower fees for each transaction, the exchange rate offered is usually lower than that of TransferWise, often ultimately leading to higher charges.

WorldRemit offers a wider range of transfer methods, some of which can get your money transferred to where it needs to be almost instantly, but transfer fees are higher for smaller amounts.

Ultimately the service you choose depends on your personal needs.

Those requiring greater global coverage and more flexible transfer methods should opt for WorldRemit, but for most customers the TransferWise service offers better value for money overall, and is extremely straightforward to use with much more online information and assistance than WorldRemit.

It’s also a better service for those wanting to send very large sums of money, as well as more regular small payments.