Disclaimer: This post contains affiliate links, where we may be compensated for any purchases you make. This does not affect the price you pay. Thanks for supporting our site! 🙂

Transferring money between foreign and UK bank accounts is one of the most annoying hidden costs of being an expat — but could the TransferWise service help to keep your costs low?

Most expats are uncomfortably familiar with the costs involved when transferring money from UK bank accounts to overseas accounts.

Whether transferring money for personal use when living in another country or sending it to loved ones abroad, foreign exchange dealers and banks most often help themselves to a big chunk of our hard earned cash as fees and commission. This can significantly reduce the final sum received after the exchange has taken place.

Thankfully, entrepreneurs Kristo Käärmann and Taavet Hinrikus – with the support of Richard Branson – have come up with a fresh way of exchanging currency without incurring huge fees in the process, and it’s called TransferWise.

What is TransferWise?

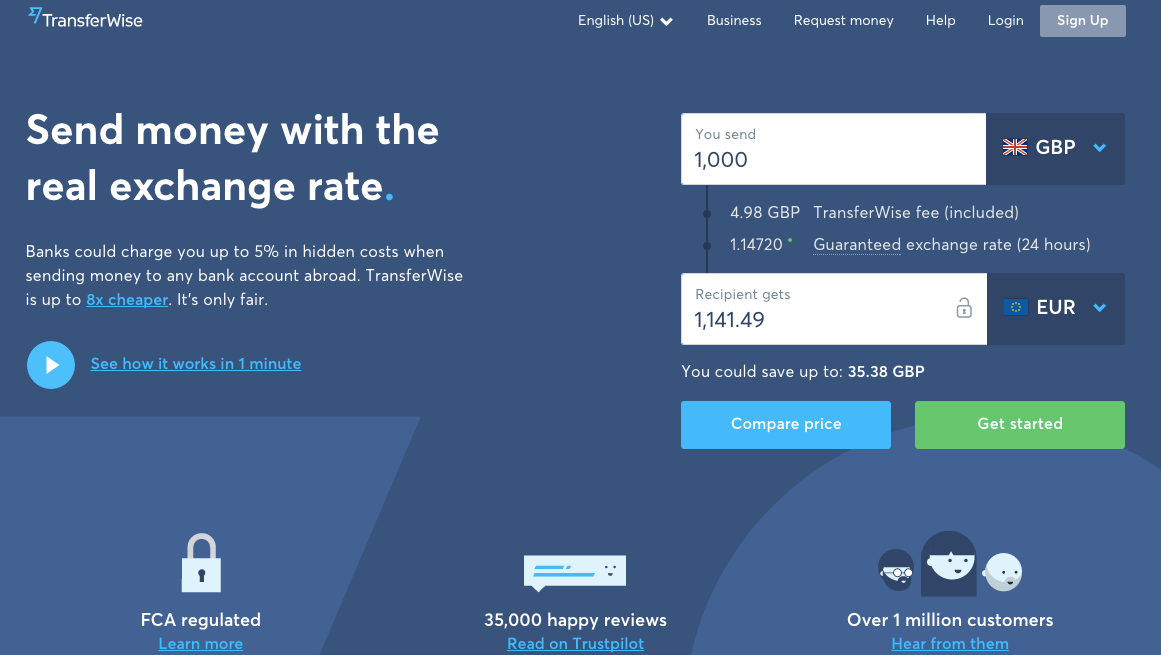

With a totally transparent business model, TransferWise is a peer-to-peer, online currency exchange service with super low fees and no hidden costs.

The TransferWise website is clear and simple to use, and once the initial set up has taken place, transactions are fast and hassle-free.

The service offers a guaranteed best rate — so if you find a better rate of exchange elsewhere they will match it.

Transferwise for expats currently supports 27 different currencies, including the possibility to both send and receive the following:

- EUR – Euro

- GBP – Pounds Sterling

- USD – US Dollar

- AUD – Australian Dollar

- CHF – Swiss Franc

- CAD – Canadian Dollar

- PLN – Polish Złoty

- SEK – Swedish Krona

- NOK – Norwegian Krone

- DKK – Danish Krone

- HUF – Hungarian Forint

- CZK – Czech Koruna

- BGN – Bulgarian Lev

- RON – Romanian Leu

- NZD – New Zealand Dollar

- JPY – Japanese Yen

- BRL – Brazilian Real

- SGD – Singapore Dollar

- HRK – Croatian Kuna

And also certain currencies that at this time can only be sent out but not received;

- INR – Indian Rupee

- HKD – Hong Kong Dollar

- MYR – Malaysian Ringgit

- PHP – Philippine Peso

- PKR – Pakistani Rupee

- MAD – Moroccan Dirham

- THB – Thai Baht

- AED – Emirati Dirham

TransferWise rates are £2 for amounts under £400, and a flat 0.5% on any sum with a value over that amount transferred using their online service, making it ideal for one-off or repeated transactions both large and small.

So how does Transferwise manage to make exchanges at such low rates?

How Does TransferWise Work?

Banks and other traditional currency transfer services work by moving money around from place to place, which incurs huge fees. TransferWise, on the other hand, makes sure the money never leaves the country it is in.

Instead, a peer-to-peer system is used (think of it as a network). What this means is that when someone wants to exchange their pounds for euros, for example, TransferWise find someone who wants to convert their euros into pounds and pays out the money from that account locally (essentially making a secure swap in the same currency between the two accounts).

Rather than your sum of money leaving the country, it is simply redirected to the accounts of other TransferWise users who need it: then, in your destination country, the money of other users is rerouted into your account where you need it.

This method enables money transfers to be up to a staggering 8 times less expensive than traditional exchanges.

To take advantage of the service, you need to register with TransferWise and create an account. Fortunately, setting this up is straightforward and customer service is at hand should you have any questions.

Making transfers is easy — it’s much like using regular online banking.

Once logged into your account, enter the details for your intended bank account and the amount you want to transfer. You can either pay using your debit card or make a direct transaction from your own online bank account.

Once you have verified the details and confirmed the transaction, you’ll receive an email from TransferWise the moment that your money has been received by them, plus an estimated delivery time. You’ll receive another email as soon as your money has been paid into the recipient’s account and the transaction has been fully completed.

TransferWise will also keep the recipient informed throughout the whole process too — handy if you’re sending money to someone else rather than moving money around within your own accounts.

The time it takes to transfer the funds depends on the currencies being exchanged, the payment method used, and any non-working days like weekends and public holidays.

Most transfers are quick and can happen the same day, although it’s best to allow up to 2 days for a transfer to be completed. The whole process should certainly take no longer than 4 working days.

It’s worth noting too, that TransferWise have also developed a mobile app for smartphones, which means that you can make payments and transfers whilst on the move in the same way that you would use the website. This is very convenient when travelling between countries.

TransferWise Review

Pros

As you might imagine, this is an extremely popular service, and the customer feedback is glowing.

Here are some of the biggest plus points according to satisfied clients…

- Very efficient service

- Simple and quick to set up accounts

- Great value for money

- Reasonable fees

- Better rates than elsewhere

- Uses genuine up to date exchange rates

- User interface is really straightforward and easy to use

- Secure and fast transactions

- Responsive, communicative and helpful customer service

- Regular email communications throughout transactions keep you well informed

Cons

Whilst most customers are extremely happy with the TransferWise service, there are a very few niggles that have been an issue for some.

Here’s a roundup of the reported glitches…

- Transfers are not immediate and are sometimes delayed

- Several documents are required in order to sign up

- Some Debit and Credit Cards are not accepted

- Not all global currencies are yet available

Overall Verdict

The overwhelmingly positive reviews from TransferWise clients are indicative of the excellent service it provides. If you’re an expat looking to transfer your money overseas, you’ll be hard pressed to find a better, cheaper money transfer solution.

When living abroad, every penny really does count, and using TransferWise is sure to significantly boost the end amount of each transaction you make. With excellent rates of exchange, ease of use, great customer service, and fast and secure transactions to a wide range of countries, this service can really make a difference to expats, students and travellers, and we highly recommend it.

Have you used TransferWise yet?